Simplify Your Bank Reconciliation with ERPNext

Automate your bank reconciliation process, eliminate manual errors, and keep your books accurate with ERPNext’s powerful reconciliation tools.

What is Bank Reconciliation?

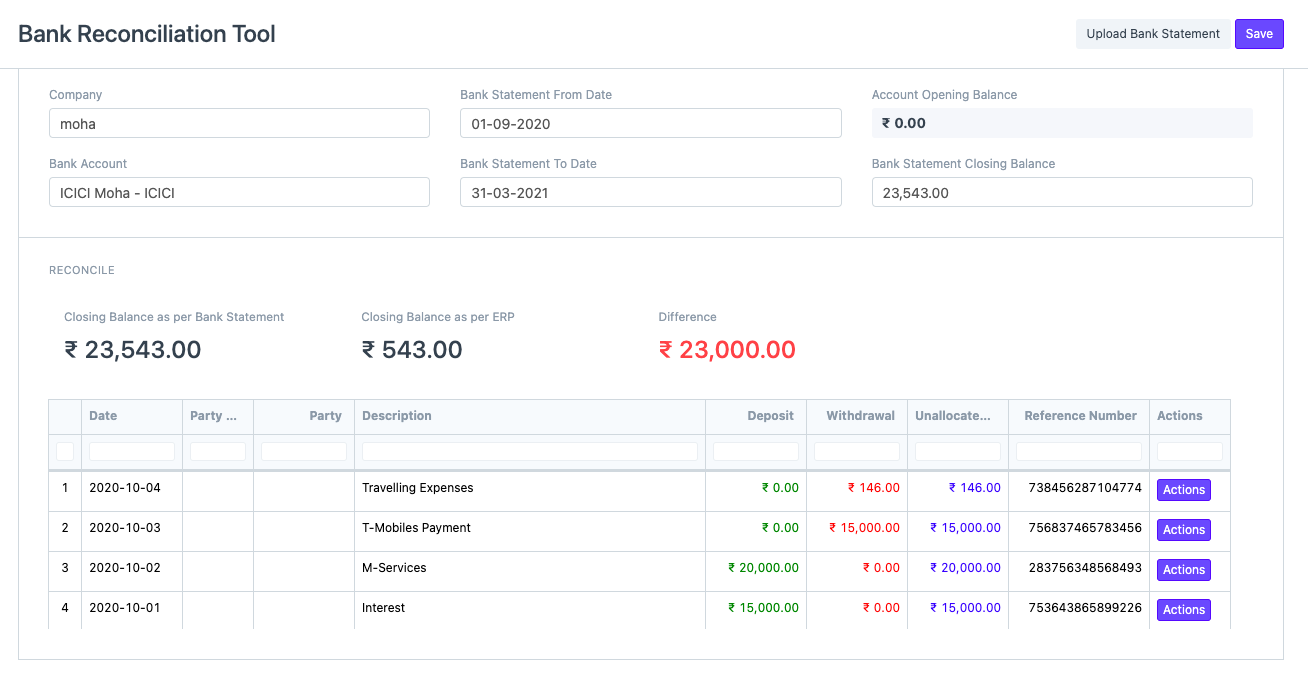

Bank Reconciliation in ERPNext ensures that the transactions recorded in your accounting system match your bank’s statement. This keeps your cash balance accurate, helps detect discrepancies, and ensures smoother financial audits.

ERPNext makes reconciliation quick with tools for importing statements, auto-matching transactions, and creating missing vouchers directly from the reconciliation screen.

Key Features of Bank Reconciliation in ERPNext

Save hours of manual work and keep your accounts error-free.

Bank Statement Import

Upload your bank statements in CSV, Excel, or MT940 format for quick reconciliation.

Auto Reconciliation

ERPNext intelligently matches bank entries with corresponding ledger transactions to save time.

Voucher Creation

Create Payment, Journal, or Receipt vouchers for unmatched transactions without leaving the screen.

Partial Match Support

Handle partial payments or multiple invoices matched to a single bank entry with ease.

Multi-Bank Support

Reconcile multiple bank accounts independently within the same ERPNext instance.

Audit-Ready Reports

Generate reconciliation statements and export them for auditors with a single click.

Why Automate Bank Reconciliation?

Manual reconciliation is time-consuming and prone to errors. With ERPNext’s automation, you can reduce reconciliation time by over 70%, improve accuracy, and free up your finance team for more strategic tasks.

- ✔ Detect discrepancies instantly

- ✔ Prevent fraud and duplicate payments

- ✔ Get a real-time view of your cash flow

- ✔ Speed up monthly and year-end closing

Start Automating Your Bank Reconciliation

Let our ERPNext experts help you set up bank statement imports, mapping, and automated matching rules for hassle-free reconciliation.

Talk to an Expert