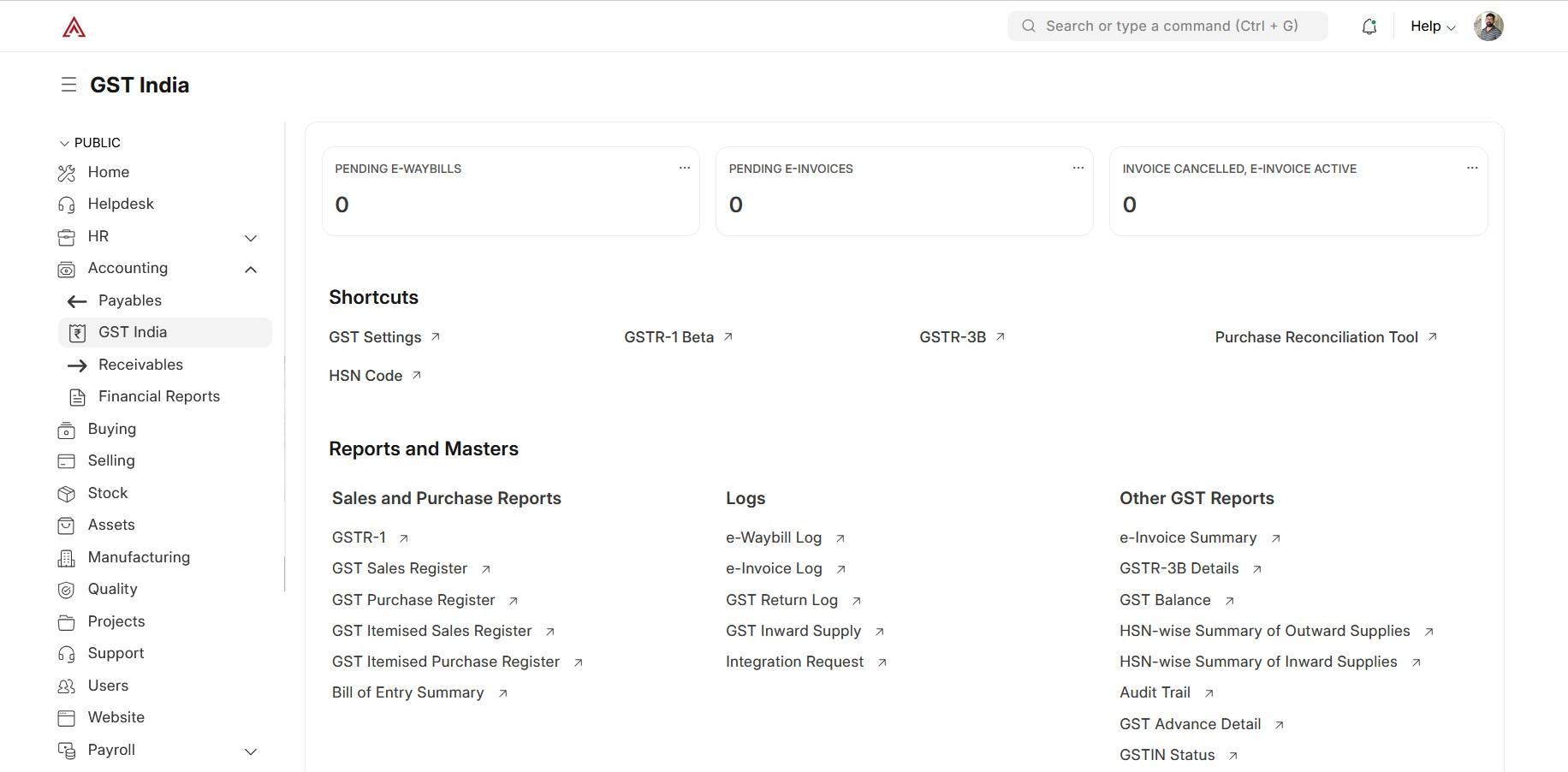

Simplify GST Compliance with ERPNext

Leverage the India Compliance App in ERPNext to automate GST calculations, e-Invoicing, e-Way Bills, purchase reconciliation, and more — keeping your business fully compliant.

What is GST in ERPNext?

The Goods and Services Tax (GST) module in ERPNext, powered by the India Compliance App, manages tax calculation, e-invoice generation, e-way bill creation, and GSTR filing — all in one place. It reduces manual work and ensures accurate filings every time.

Key GST Features in ERPNext

Everything you need for seamless GST compliance, automated directly in your ERPNext workflow.

Automatic GST Calculation

ERPNext applies CGST, SGST, and IGST based on the state of the party and place of supply.

E-Invoice Generation

Generate IRN, QR code, and digitally signed invoice directly from ERPNext — fully compliant with GSTN APIs.

E-Way Bill Creation

Create e-way bills from sales invoices or delivery notes with automatic distance calculation and validity tracking.

GSTR-1, 3B & 2B Reconciliation

Upload GSTR-2B JSON and reconcile purchase invoices to claim correct Input Tax Credit (ITC).

Auto Customer/Supplier Creation

Create parties by just entering GSTIN — ERPNext fetches legal name, address, and state code automatically.

Comprehensive GST Reports

Generate HSN/SAC summary, GST payment register, and GST audit-ready reports in seconds.

Best Practices for GST Compliance

Keep your GST workflow accurate and stress-free with these tips:

- ✔ Enable e-invoicing for B2B invoices if turnover exceeds the threshold.

- ✔ Regularly reconcile GSTR-2B to avoid ITC mismatches.

- ✔ Use auto-fetch GSTIN feature to avoid manual data entry errors.

- ✔ Generate e-way bills before dispatch to stay compliant.

- ✔ File GSTR-1 and GSTR-3B on time to avoid penalties and interest.

Need Help with GST Setup?

Our ERPNext experts can configure GST, e-invoicing, e-way bills, and reconciliation workflows tailored for your business.

Talk to an Expert