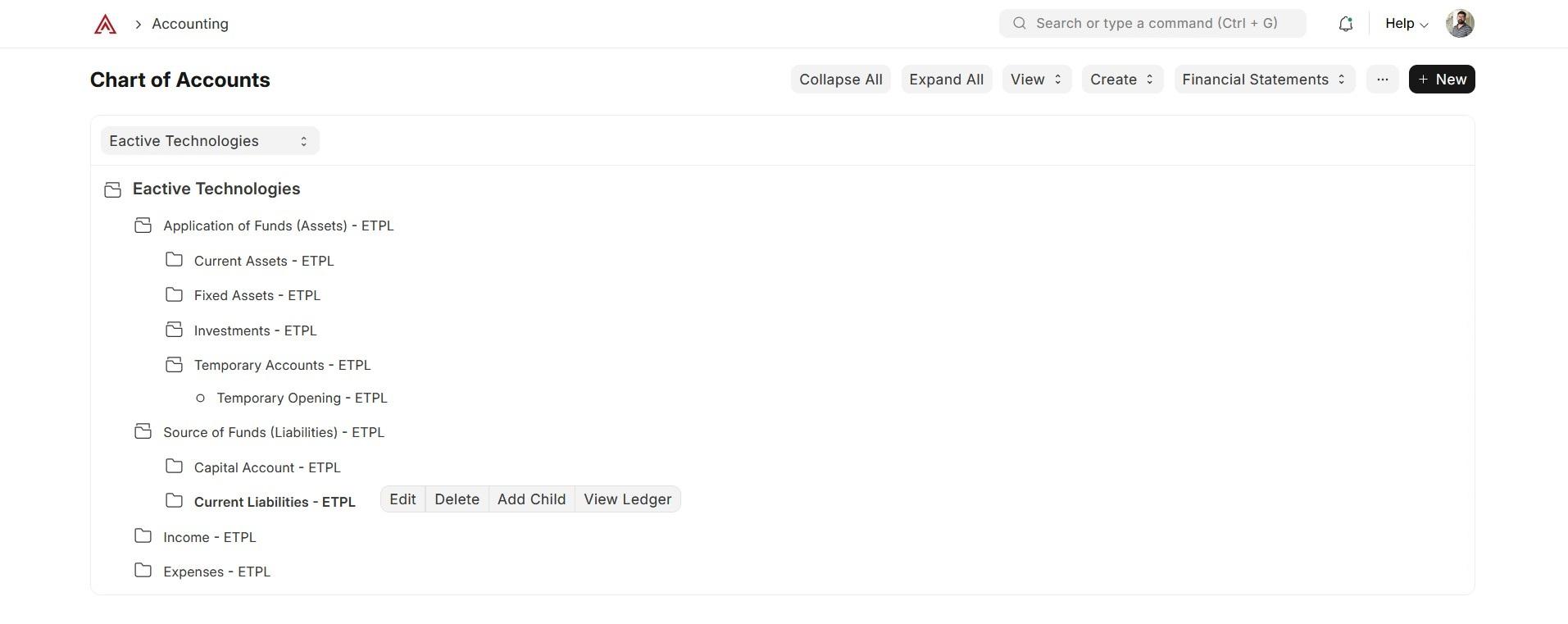

Strong Financials Start with a Good Chart of Accounts

Learn how ERPNext helps you create, manage, and automate your financial accounting with a well-structured and customizable Chart of Accounts (CoA).

A well-designed Chart of Accounts is the backbone of accurate financial reporting

What is a Chart of Accounts?

The Chart of Accounts (CoA) in ERPNext is a hierarchical list of accounts used to record all your company’s financial transactions. It forms the foundation for Balance Sheets, Profit & Loss reports, and accurate bookkeeping.

Key Features of Chart of Accounts in ERPNext

Discover why ERPNext makes managing CoA effortless and flexible for every business size.

Customizable Structure

Add, rename, or rearrange accounts as per your business requirements.

Multi-Company Support

Manage multiple company accounts from a single ERPNext instance.

Tax-Ready Accounts

Pre-configured tax ledgers for GST, VAT, and TDS make compliance easy.

Integration with Modules

Directly links with Sales, Purchase, Payroll, and Inventory modules for automated posting.

Powerful Reporting

Generate Balance Sheet, Trial Balance, Profit & Loss with a single click.

Audit Trail

Track every change to your accounts with a built-in audit log.

Structure of Chart of Accounts in ERPNext

ERPNext organizes accounts in a tree structure, making it easy to group transactions and get meaningful reports.

ASSETS

Assets are everything a business owns that has value, including cash, equipment, inventory, and property. They represent the resources that generate future income and support business growth. Proper asset management helps maintain liquidity, plan investments, and improve overall financial health.

LIABILITIES

Liabilities are what a business owes to others — such as loans, accounts payable, and other financial obligations. Managing liabilities effectively ensures timely repayments, reduces financial risk, and maintains a healthy balance sheet.

INCOMES

Income refers to all the money earned by a business through sales, services, or other revenue streams. Tracking income helps measure profitability, analyze growth trends, and make better financial decisions for long-term success.

EXPENSES

Expenses are the costs a business incurs to operate, including rent, salaries, utilities, and raw materials. Monitoring expenses regularly helps control costs, improve efficiency, and increase profitability by reducing unnecessary spending.

Best Practices for Chart of Accounts Setup

Follow these tips to maintain a clean, meaningful, and scalable Chart of Accounts in ERPNext:

- ✔ Keep account names simple and descriptive.

- ✔ Avoid creating duplicate accounts for similar purposes.

- ✔ Group accounts logically for better reporting.

- ✔ Use numbering system (1000-Assets, 2000-Liabilities) for easy identification.

- ✔ Periodically review and deactivate unused accounts.

Need Help Setting Up Your Chart of Accounts?

Our ERPNext experts can design and implement a robust Chart of Accounts tailored to your industry and reporting needs.

Talk to an Expert